Growth Guarantee Scheme: What the 31st March 2026 End Date Means

The Growth Guarantee Scheme (GGS) is a UK Government-backed guarantee programme delivered through the British Business Bank and a wide panel of accredited lenders. It is designed to support smaller UK businesses that are looking to invest, grow, or strengthen cashflow, where lenders may want additional comfort. The key date to know: the scheme is […]

Unsecured Business Loans in the UK – Fast, Flexible Funding without Physical Security

When you need working capital quickly-without tying property or equipment to the deal-unsecured business loans can be a smart, straightforward route. In this guide, we explain how unsecured loans work, where they fit, and how to prepare a strong application. You’ll also find direct links to compare options with The Funding Store so you can […]

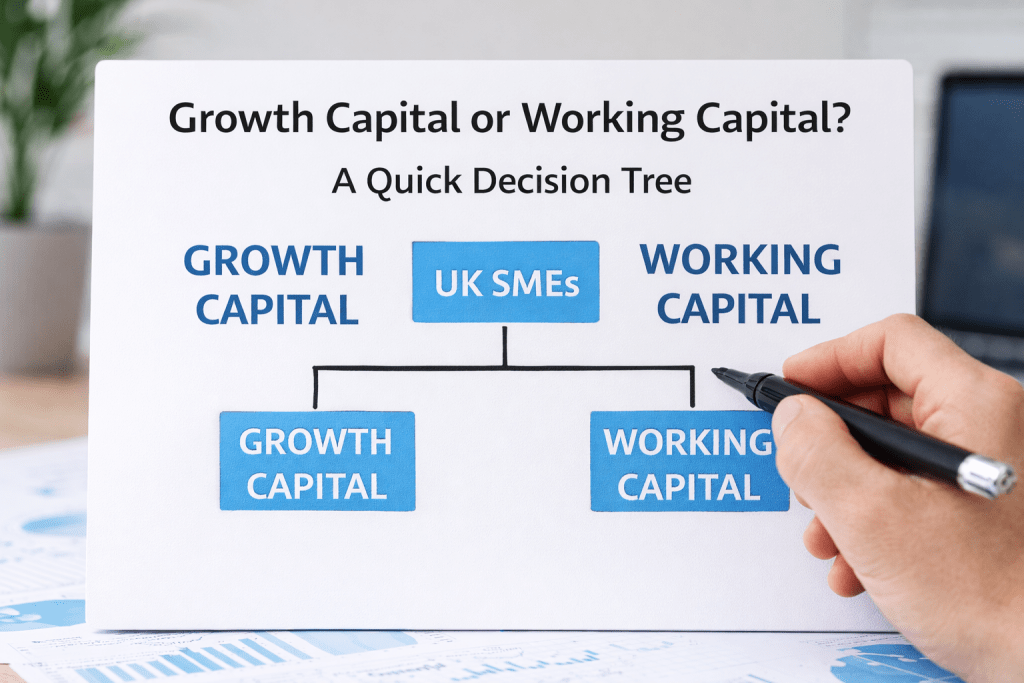

Growth Capital or Working Capital? A Quick Decision Tree for UK SMEs

Choosing the wrong funding tool can cost more, slow decisions, and create cash-flow friction. This practical guide shows you how to pick the right finance for the right job – whether you’re covering short-term gaps or backing long-term growth. Along the way, you’ll find clear routes into our most popular options so you can compare […]

Invoice Finance Solutions to Keep Your Cash Flow Healthy

When customers pay on 30–90 day terms, strong sales can still leave you short of working capital. This problem–solution playbook shows how to use invoice finance practically-not just what it is-to smooth December/January peaks, fund growth, and protect day-to-day operations. New to the concept? Learn the fundamentals on our pillar page: Invoice Finance.Ready to compare […]

UK SMEs Year-End Playbook 2025 — Cash Flow, Funding & Growth Ideas for a Strong Start to 2026

The festive rush can be brilliant for sales-and brutal on cash flow. As 2025 wraps up, many UK businesses face the same year-end puzzle: higher costs, slower payer behaviour, and ambitious plans for Q1. This guide brings practical tips you can put to work now, plus the funding routes, that help you move quickly without […]

What are the top 5 reasons to take a Corporation tax loan?

Managing corporation tax obligations can be a daunting task for many UK businesses. With looming deadlines and the need for accurate cash flow management, a corporation tax loan offers a valuable solution. In this guide, we explore the top five reasons why your business should consider taking a corporation tax loan and how it can […]

Top 5 Reasons to Use Trade Finance for Your Business

In today’s globalised economy, businesses face various challenges when trading internationally. Trade finance offers essential solutions to help manage these challenges while unlocking growth opportunities. Whether you’re an importer, exporter, or involved in domestic trade, understanding the value of trade finance is key to building a sustainable and successful business. Here are the top five […]

The Benefits of Taking a VAT Loan for UK Businesses

Exploring VAT Loans to help manage finances and tax obligations, which can be a significant challenge for UK businesses, could be the right solution for your business. A VAT loan is a powerful tool that can help you manage cash flow more effectively and keep your business on track, especially during times of financial strain. […]

Unlocking the Benefits of Asset Finance for UK Farmers

Farming in the UK is a capital-intensive industry that faces numerous financial challenges. From acquiring essential machinery and tractors to investing in livestock and land, farmers must deal with large expenses to maintain and grow their businesses. Asset finance has emerged as a popular financial solution, providing farmers with the flexibility to acquire the equipment […]

Top 5 Reasons for Asset Refinance

Asset refinance can be a valuable financial tool for businesses looking to optimise their resources, improve cash flow, and fund growth. Whether you’re facing short-term cash needs or looking to upgrade your equipment, asset refinance offers a flexible way to tap into the value of your existing assets. In this guide, we’ll explore the top […]